7 Tips for Personal Data Protection

Personal data protection is a hot topic right now. With the recent Facebook scandal, many people are starting to ask themselves how they can protect their personal information from being sold without their knowledge.

Here, we will discuss 7 tips for businesses that want to increase customer trust and prevent any future scandals like this one.

1. Make sure your employees are aware of the company's data protection policy.

Employees need to know how they should handle customer data. Make sure employees are fully aware of your company's data protection policy so that they can follow it properly. This will help prevent costly mistakes from being made and avoid putting the business at risk for a potential fine or lawsuit.

In Singapore, a breach in the Data Protection Policy Act may cause you to be liable for a fine of up to $1 million dollars or 10% of your annual revenue whichever is higher.

2. Install strong firewalls to block outside threats.

Your business's firewall is one of the first lines of defence against hackers. A strong, up-to-date firewall will block outside threats and ensure that your data stays safe. This gives you peace of mind knowing that no external threat can access your system or cause damage to it.

3. Encrypt all sensitive information before it is sent out over the internet.

When sending sensitive information over the internet (for example, with email), make sure it is encrypted. This will prevent any unwanted parties from gaining access to your data and using it for their own personal gain.

Email is not 100% secure. Make sure you encrypt all sensitive information before it's sent out.

Don't click on any suspicious links in emails, even if they look like they are from someone you know. This could be part of a phishing attack and you may end up giving away personal or business information.

4. Limit who has access to sensitive data, including customer records and financial information.

Only give employees access to the information they need in order to do their jobs. This will prevent any unauthorized use of sensitive data and keep your business safe.

Limit who has access to customer records, financial information, etc., so that only those who absolutely need it can gain access.

Don't store passwords with personal or company files.

5. Make sure to update any software on devices regularly.

Software updates are crucial when it comes to keeping your devices safe. These software updates often include patches for security holes that hackers can exploit, so they're extremely important to keep up with.

Don't ignore or postpone updating devices and any installed software! Patches can be downloaded from the official websites of operating systems (such as Windows).

6. Use strong passwords - never use words that are in the dictionary or anything related to you

The best passwords are random combinations of letters, numbers and special characters. They should be long (minimum 12-15 characters) and not contain anything that can personally identify you or relate to your business.

A password manager is a good option for those who find it difficult to create strong, unique passwords themselves. Password managers generate complex passwords for you and save them so that all you have to do is remember one password.

Strong passwords are important for both individuals and businesses! Don't use words that can be found in the dictionary or any similar word related to your business/name.

Don't share sensitive information over email. If there's something you need to discuss with someone, call them instead.

Don't use the same passwords for multiple accounts and websites! If a hacker gets ahold of one password, they can access your whole online presence.

Avoid using public WiFi if you're visiting an unfamiliar location or going to a place where sensitive data is being handled (for example, in hospitals). Public WiFi networks are not secure and can allow hackers to access your devices when you're on them.

Don't leave any laptops or other portable devices with sensitive data unattended in public places! Hackers often install keyloggers (keyboard trackers) that will record everything typed on the device, including passwords and credit card numbers. There is software designed specifically for this.

7. Create a data protection policy for your company

Create a data protection policy for your business that specifies the use of personal and sensitive information. This will prevent any violations regarding its usage, as well as ensure you're acting within legal boundaries of the Personal Data Protection Act (PDPA) of Singapore.

In fact, all organisations, including sole proprietorships are required to designate a Data Protection Officer (DPO) whose job is to ensure the organisation complies with the PDPA.

Data protection policy compliance is important for any organisation. We can help you implement a data protection policy for your company so that all of the information you collect from customers is handled responsibly and in accordance with PDPA standards.

Download the Telegram app and follow us for the latest updates: https://t.me/sgcompanyservices

How To Become A Millionaire With Cryptocurrency?

How to become a millionaire through cryptocurrency? In short, you cannot. Of course not unless you are willing to bet big on it. And by saying 'bet', I mean yes, nobody can predict the prices of Bitcoin (BTC) tomorrow much less the day after. A lot of the 'gurus' out there will convince you otherwise, claiming that they have the best system, trading system, AI trading so on and so forth. In this article, I just want to share with you my humble opinion and little journey dabbling in cryptocurrency for the past 1 year.

1. Never put in more than you can afford to lose

Someone once told me before, the first rule of money, is never to lose any money. I started off with USD $2,500. Just to try it out you know. Because I have heard so many rags to riches stories, people going from broke to millionaires by trading BTC. Get the drift? Like I said previously, not unless you are willing to wager big time on it. Even if the BTC price was USD $20,000 (I am not talking about the early traders), how can an average person on the street own 10 BTCs without selling off his house and car?

And like I said, I dare say even Elon Musk himself does not know what will happen next (though he has a massive influence over it, you can click here). The next thing you know, if the Chinese government decides to come out with new restrictions, prices will crash again.

As of today, my portfolio is worth a grand total of USD $4,899.71 if I liquidate everything as of this instance. Fantastic? Probably. But another wise friend once told me, all the self-proclaimed gurus (investments of any kind), never told you about their losses. They only show you their wins. So be wise.

2. Money is the root of all evil

NO. Greed is. Since I started fiddling around with cryptocurrency, mainly BTC and Ethereum (ETH). Right before the crash in May 2021, I sold some, made a profit and I bought in at an all-time high price once more thinking that it will go higher. And you know the story. So refer back to point number 1. Making lesser profits is better than losses. Yes, you can always say that just hold on to it and wait for the rebound. But there is always something called opportunity costs, especially if your stakes on it is much higher than mine.

3. Keep track of what you do

On the advice of a close friend of mine, you should always keep a spreadsheet of your gains and losses. Buy price, sell price, for easy reference. Most people will say it is common sense to do so, but most don't. So if you are serious about it and want to make money out of it, I suggest you do so.

4. Other people's opinion

Well along the journey you will hear tons of advice, albeit some are well-meaning, some are just plain silly (I am being nice here). Some will tell you why trade? Just buy and leave it there and never look at them again and let your descendants discover that they are actually billionaires 20 years later.

What I wish to tell you is that it is all up to you. I cannot emphasise this enough. Why should you let others tell you what you should do with the money or profits? Even though you read this, you will still let other people's opinions influence you. I am not saying be stubborn and unreasonable or irresponsible and treat it as a gamble, but I am just saying whether you choose to take their advice or not, whether they turn out to be correct or wrong, you should not blame anyone except yourself.

You call the shots yourself. It is your account. Your own money. Blaming someone else for a decision you make with your own money is anything but foolish.

Conclusion

To further prove my point in number 4, compare the headlines of this article and the other one. Yes, there is a lot of driving factors behind every bull or bear run. But ultimately it is just market sentiments overall. When the market is feeling optimistic, cryptocurrency, in general, will experience a bull run.

No doubt pushing towards the adoption of digital coins can mean a huge deal for cryptocurrency in future but until then, I dare say that most retail investors are just putting in some money and hoping to make some money out of it that fund our next vacation. So be careful of what the media is always saying. Their business is to get more subscribers, the typical doomsday 'newsflash' tactics. They can tell you about cryptocurrency as much as I can tell you about the number of white hair on Joe Biden's head.

One thing is for sure, if it is really not something worth looking at, the Singapore government would not want to be running it themselves, you can read more here.

Contact us if you have any questions related to bringing your blockchain companies to Singapore.

Download the Telegram app and follow us for the latest updates: https://t.me/sgcompanyservices

How To Start A Singapore Company

Forming a Singapore company

A company is a separate, distinct legal entity from its shareholders and directors. In other words, it is like a child who is considered a different 'thing' from his or her parents. There are mainly two forms of companies, public and private. In this article, we will explain to you how to start a Singapore company and the various options you can start one.

Public companies normally have at least 50 shareholders and are listed with the Singapore Stock Exchange. Conversely, private companies can have up to a maximum of 50 shareholders and are not listed. The shareholders are the beneficial owners of the companies. Therefore, they are responsible for appointing directors to help them run the company. In accordance with the Singapore Companies Act (CA), any local or foreigner above the age of 18 is allowed to incorporate a company in Singapore.

Why start a company?

Unlike sole proprietors and partnerships, the shareholders of companies have limited liabilities. Companies are separate legal 'bodies' from the owners. Therefore, owners/shareholders are not personally liable for the debts of the company, or any legal action against the company in normal circumstances. However, in certain special circumstances, owners/shareholders can be liable for the debts of the company.

Companies have more legal requirements to comply with in comparison. For example, failing to file annual returns and/or to hold annual general meetings, can result in penalties. These penalties are imposed by the Accounting and Corporate Regulatory Authority (ACRA). In addition, there is more work to wind up a company too. It can take up to 5 months to remove a company from the register.

A company structure is the most suitable if you wish to grow your company. Compared to other models, the company structure makes raising capital and transferring ownership easier. To find out more, you can read up the various business models in Singapore here.

Things to note before registration

Directors

At least 1 director residing in Singapore is required to be appointed. By definition, any individual who is a Singapore citizen, Singapore Permanent Resident, or holds an EntrePass, Employment Pass, Dependant’s Pass, fulfils the requirement of residing in Singapore. A Singapore company can appoint as many local or foreign directors as it chooses. To qualify as a director, the appointee must be at least 18 years old, not bankrupt and have no prior conviction of any malpractice. A director need not be a shareholder and vice versa.

Shareholders or members

Singapore private limited companies must have at least 1 shareholder and not more than 50 shareholders. A natural person (individual) or another legal entity (company or a trust) can be a shareholder. Singapore companies can be either 100% local or foreign-owned. Also, existing shares are transferrable or you can issue new shares to another person after the company has been incorporated.

Corporate secretary

Per the Company act, all companies must appoint a qualified corporate secretary within 6 months after incorporation. Like the directors, a corporate secretary has to be a natural person (individual) who is living in Singapore. An important note is that where there is only one shareholder/director, that person is not allowed to be the corporate secretary.

Paid-up capital

The minimum paid-up capital to incorporate is S$1. Subsequently, you can increase the paid-up share capital anytime after incorporation.

A registered address

A Singapore address must be used as the registered address of the new company. In other words, it can be either a commercial or residential address as long as it is a physical address and not a P.O. box. For instance, Singapore residents can use their home address as their company's registered address under the Home Office Scheme. Similarly, this scheme applies to private properties as well.

Owners/occupiers should check their eligibility and obtain HDB's approval. For private residential property owners, they have to get approval from Urban Redevelopment Authority. Most importantly, the registered office in Singapore has to be accessible and operational during office hours to the public.

Company tax

The tax rate in Singapore for companies is 17%. On top of that, Singapore companies get extremely attractive tax incentives and exemptions. A newly incorporated company can get tax exemptions on its first S$200,000 chargeable income. Above all, there is no capital gains nor dividend taxes for Singapore registered companies. Click here for our guide to corporate tax in Singapore.

Documents needed

For company incorporation, ACRA requires the following information:

- Choose an ACRA approved company name

- Description of company's activities

- All shareholders’ particulars

- All directors’ particulars

- The registered address of the company

- The corporate secretary’s particulars

- Company constitution

- The company’s proposed fiscal year-end date

Incorporation

Company registration is processed online in Singapore. Usually, the incorporation takes 1 to 2 days. Fortunately, you need not be present in Singapore to register a company if you do not reside in Singapore. However, it is advisable to engage the services of a registered filing agent such as us to do so for you.

1. Choosing an approved name and address

To incorporate a company in Singapore, you must first choose an approved name by ACRA. To know how to do so, read our other article here.

Normally, the result of the incorporation is within an hour approximately. However, if the proposed company name has certain sensitive words, the name approval may take up to a few days.

Ensure that the proposed company name:

- Not identical or similar to any existing Singapore companies' names

- No infringement of any trademarks

- Not vulgar or offensive

- Not under reservation

You can reserve the proposed company name for up to 60 days from the date of application. If need to, you can apply for an extension before the expiration date for another 60 days' validity.

2. Adopting company’s constitution

Every company must have a constitution. It is a legal document that defines the rules and regulations on how the company is governed. It also details its structure, shareholder rights and all other rules for the management of the company.

If you wish to avoid hefty legal fees to draft your constitution from scratch, you can adopt the model constitution found here.

3. Completion of registration

Once you have completed the above steps, you can finalise the registration. In order to do that, you need to fill in key information like company shareholders details, and the personal particulars of all directors and officers. In the case where the company's purpose is to set up a school, the incorporation process will take from 14 days to 2 months.

Shareholder agreement

Besides the company constitution, a shareholder agreement is also an important legal document for the incorporation. This document sets the rules and regulations for managing the company. In addition, it also details the relationship between all parties such as the shareholders and directors. A shareholder agreement supplements the company constitution by covering specific situations. Moreover, it serves to resolve any form of disputes should they arise.

Documents issued after registration

ACRA will give you a few documents upon successful incorporation of the company:

1. Certificate of Incorporation

After successful incorporation, ACRA will send an official email notification confirming the registration which includes the unique entity number (UEN) and serves as the official certificate of incorporation. ACRA no longer issues a hard copy of the certificate as its no longer required. If you prefer a hard copy, you can submit a request online where it is chargeable.

2. Business profile

Generally, you can download the business profile within an hour after successful registration and it contains:

- Company name and UEN

- Previous known names for the company (if applicable)

- Date of incorporation

- Principal business activities

- The paid-up share capital

- Registered address

- Shareholders’ particulars

- Directors’ particulars

- Company secretary’s particulars

These two documents are sufficient in Singapore for all contractual and legal purposes. Some of these purposes include the opening of corporate bank accounts, signing of a rental lease, subscription to internet providers.

Maintenance fees of a company

After registering your company, you will incur certain fees on an annual basis to ensure compliance with the authorities. Do note, any late filing or compliance omissions can result in fines and penalties for the company.

Contact Us

If you have any questions at all regarding the setting up of a company in Singapore, contact us today!

Download the Telegram app and follow us for the latest updates: https://t.me/sgcompanyservices

Directors’ Duties in Singapore

The board of directors, which include the Chief Executive Officer (CEO), usually manages a company's operations. This is in accordance with the Companies Act (CA) section 157A. In this article, we will discuss what the directors' duties in Singapore are.

When it comes to the day-to-day tasks of the company, the company executives are responsible for executing them. As prescribed by the CA, there are important company decisions that directors must make in line with their obligations. Failure to do so, the directors potentially face civil lawsuits, criminal penalties (such as jail terms) and can be subjected to being removed or terminated from the company.

Duties prescribed by the law

These are duties under the legislation of Singapore, an example will be the Companies Act.

Disclosure of interests in transactions

As prescribed in section 156 of the CA, if a director has any form of interest in a particular transaction or potential transaction, he or she needs to disclose it during a directors’ meeting. However, such disclosure is not required when:

- 'the director's interest consists only of being a shareholder or creditor of the company which is interested in the transaction,

- 'the director's interest can be properly defined as not of a material interest'.

In section 156(3) of the CA, there are other exceptions a director is considered to have an interest in.

Other than declaring the nature and extent of his interest in the other company that is dealing with his own, the director must also declare the extent of any potential conflicts with regards to him executing his director’s duties. This could be due to the fact that he is also holding an office in the other company for example.

Failure to do so will potentially result in a fine of up to SGD $5000, or a jail term of up to 12 months.

Duty to be reasonably diligent and act honestly

As prescribed in CA section 157, all directors have a 'duty in acting honestly and to use reasonable diligence during the execution of his duties while holding office'.

A director shall not use any information obtained as a result of his position in the company to gain an unfair advantage for himself or for other people or to cause harm or damage to the company.

If the director is guilty of such a breach, he or she is liable to the company. The liability exposure will depend on the profits gained by him or herself, and any damages incurred by the company. There will also be potential criminal liabilities and penalties.

Duties under the common law

They consist of duties recognised in previous court cases. The duties under common law will overlap with the statutory duties, as statutes are considered codification of the duties under common law. However, such codification doesn't mean it excludes the common law duties.

Acting in good faith for the interest of the company

Directors have a fiduciary duty to always act in good faith towards the company, for the interest of the company.

Avoiding conflicts of interest

AS discussed above, the director must declare any conflicts of interest (whether it has happened or not) he or she has in any company dealing with the board. For example, he or she holds an office in a rival company.

Duties of care, diligence and skill

If the directors fail in these duties, they can be sued for negligence.

The above form some of the main responsibilities and duties with regards to being directors in a company. As more cases surfaced in the commercial world, there will be new rulings pertaining to what constitutes a director's duties.

Other types of duties

Besides such general definitions, there are more specific restrictions on what the directors can or cannot do, including acts of omission.

An example will be in section 162 of the CA, which talks about loans to directors. By default, subjected to some exceptions, a company is not allowed to give a loan to a director. The directors who authorised such loans will be liable for indemnifying the company against any potential losses. All parties involved will be personally liable for criminal proceedings against them.

Negative duties are normally specific with regards to the transaction types (for example registration of charges). However, there are too many to list them all down. You can find them under the corresponding section in the Companies Act.

Contact us

This article only serves as a brief guide to the director's duties in Singapore. In reality, it entails a larger and wider scope of duties.

If you have any questions, please do not hesitate to contact us!

Download the Telegram app and follow us for the latest updates: https://t.me/sgcompanyservices

How To Appoint Company Directors?

In Singapore, all companies are required to have a minimum of 1 director who is a Singapore resident. Hence, it is crucial for you to know the requirements on how to appoint company directors in your Singapore company.

Who is qualified to be a director

In order to qualify as a director, the person must be:

- A natural person (i.e. a human being, you cannot appoint another company as a director);

- Must be 18 years old and above; and

- Has full legal capacity (must be of a sound mind)

The person cannot be an undischarged bankrupt and does not fall into automatic disqualification. You can read in detail about how a director can be automatically disqualified here.

Different types of directors

- An Executive Director is normally an employee under the company. This is typically a full-time position that involves managing the daily affairs of the company. Directors have different functions from the Chief Executive Officer (CEO) of the company, inclusive of managing directors.

- Non-Executive Director is not an employee under the company. He or she does not get involved in the daily operations. He or she normally sits on the board of directors to offer neutral opinions, stature, external experiences or an objective opinion of the company's standing.

- Independent Director is someone who has absolutely nil relations with the company, affiliated companies, shareholders or officers that will interfere with the independent director’s opinion. Executive directors are not independent directors because the employment relationship will potentially impair their independent judgements and give rise to a potential conflict of interest.

- A Nominee Director (ND) is a person that is being nominated by a major shareholder to be the company's director on their behalf. An ND will have the exact obligations mandated in the Companies Act (CA), just like a regular director.

- A De Facto Director are individuals who are fully responsible for directors’ duties. They openly act like they are formally appointed directors without formal appointment. De facto directors need to comply with all provisions under the CA pertaining to a director who is formally appointed.

- Finally, a Shadow Director is a person who constantly gives advice to the formally appointed directors, who decide on company matters, for example, a business strategy. These are individuals who are not formal directors and don't openly act in the capacity of directors. A shadow director has to fulfil all directors’ duties under the CA as well.

How to appoint directors

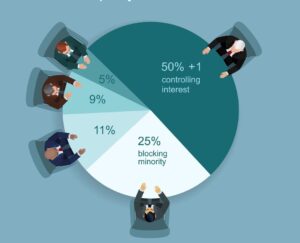

The company's constitution normally states the process for appointing directors. This can be done through an ordinary resolution passed by the shareholders in an extraordinary general meeting (EGM).

It requires a minimum of 50% majority of the votes in the EGM to appoint a director. The resolution will usually state the exact appointment (e.g. Independent Director) and the date on which this new director is to begin his duties.

The constitution may also state other ways for appointing directors. For example, it may state that only specific shareholders or the board of directors have vested powers for the appointment of directors. The individual needs to provide a written (signed) agreement and a non-disqualification statement in order to act as a director.

After appointing the director in accordance with the constitution, the company must notify ACRA within 14 days from the appointment date of the director.

The personal information of the new director must be provided to Accounting and Corporate Regulatory Authority (ACRA):

- Name

- Identification number (i.e. passport number for foreigners)

- The office he or she is holding (in this case is a director)

- Nationality

- Residential address (the corporate secretary will need to have a copy of the proof of residential address such as utility or credit card bill)

- Primary contact number and email address

- Date of appointment

Once the company files the information with ACRA, the appointment is effective immediately. You can verify this through the register of directors.

What authority a director has

The normal functions of a board of directors are to manage the company by coming up with different policies and company objectives, approval of budgets annually, select and appointing key company executive officers like the CEO and the Chief Financial Officer (CFO).

The CA provides that the board of directors can exercise all the powers unless the company's constitution or CA states that such a particular act is not legitimate or legal, without the approval of the shareholders.

As stated below, the CA sets out that these tasks are allowed only if the shareholders approve them:

- Disposing business assets of the company

- Issuing of new shares

- Payments being issued to any director(s) as a form of compensation (for example the director has been terminated)

- Giving of payment or increment of salaries (for example, fees and allowances for expenses) to any director(s)

Duties of a director

Directors are the business decision-makers, thus they have to exercise their powers with a duty of care under the law. Failure to do so may potentially face liability in a civil and/or criminal lawsuit. The director may potentially be removed from the company as well. In the case of a criminal lawsuit, penalties such as fines and/or jail terms can apply too.

For more information on the duties of a director in a Singapore company, click here.

How much is a director's remuneration

Under normal circumstances, the company ought to pay a form of fees to the directors for the services and tasks they perform. The CA doesn't put a limit on the amount of fees paid to a director. But as discussed previously, regarding directors’ remuneration, approval must be obtained from the company's shareholders.

For executive directors, the company pays them a salary in accordance with their contract terms (normally an employment contract).

Removing directors

Directors can be removed from the company by means of an ordinary resolution of the shareholders.

For public companies, you need the shareholders to approve any removal of directors. In the case of private companies (Pte Ltd), the company's constitution can state other methods for the removal of directors. In some cases, the company's constitution may even set out that the shareholders have no right to remove any of the directors.

The company needs to adhere to its constitution under all circumstances. It is the so-called 'rulebook' of the company.

Contact us

If you are unsure of how you can do so, it is advisable that you get in touch with a lawyer or a corporate secretarial firm like us today!

Download the Telegram app and follow us for the latest updates: https://t.me/sgcompanyservices

How To: Remove A Director For Singapore Companies

Company directors have an important role in the company's business operations. There are a few ways an individual can stop being a director either through resignation, termination or disqualification. In this article, we will discuss the necessary steps and procedures to remove a Singapore company's director.

1. Removing directors

Reasons why a company will remove a director

A company may want to remove a director prematurely for a few reasons such as:

- Personal conduct is poor;

- Breaching of the director’s duties; or

- Unsatisfactory management of company leading to dismal performance;

Who has the authority to remove directors?

Only shareholders can remove directors. For public companies, take note that directors are unable to remove other directors, in accordance with section 152(8) of the Companies Act (CA).

Removal of a director in private limited (Pte Ltd) companies

Keep in mind that to remove a company's director, you must comply with the company’s constitution. Section 152(9) of the CA clearly mention that the shareholders of a company can remove the director(s) by means of an ordinary resolution (more than 50% of shareholders voted in favour of the removal) unless there is a contrary provision in the company's constitution.

Shareholders must issue a written notice, with a minimum of 14 days notice period. If more than 95% of the voting rights agree to the removal, then this requirement can be dispensed.

If your company adopts the Model Constitution, the director can be removed by an ordinary resolution with at least 14 days notice.

A company’s constitution can always have some other additional requirements. An example will be requiring the shareholders to pass a special resolution for the removal of the director (more than 75% of votes are in favour of removing the director).

To begin the procedure of the removal of a director, the shareholders must convene a general meeting and come together to vote if they should remove the director or not, and then pass the resolution.

The constitution of the company can also have a special clause or condition on the matter of removing directors in some situations. Such as in the event of immoral or questionable conduct.

If there is such a case, the shareholders can remove the said director without voting, unless stated otherwise in the company’s constitution.

Removing a public company's director(s)

For the removal of a public company's director, as stated in section 152 of the CA the following requirements are needed:

- Unless it is set out in the company’s constitution or there is an existing agreement between the company and director, a public company's shareholders can remove any director by means of an ordinary resolution (there are more than 50% of the votes in favour of removal);

- The company shall give a special notice with regards to the resolution of the removal of the director, to all shareholders and also the said director involved. Such notice has to be given no lesser than 28 days before the actual general meeting. In the event it is impracticable, such notice can be given no lesser than 14 days before the meeting.

When does the directorship officially end?

In accordance with section 152(1) of the CA, a director's removal shall not be in effect up to the point his or her successor is appointed.

The out-going directorship officially ends when the company has updated the new director's details with the Accounting and Corporate Regulatory Authority (ACRA).

2. A disqualified director

A disqualified director is not to continue to act as a director or run any local or foreign companies. He or she can continue doing so only if he or she seeks clearance from the Official Assignee or the General Division of the High Court.

How will a director become disqualified?

A director will become disqualified under the below circumstances:

- a director is bankrupt;

- the Singapore court makes a disqualification order. In the case of an unfit director of companies which end up insolvent, the company is being winded up for national security reasons, or when the director is guilty of offences relating to the running or incorporation of companies in Singapore;

- the director is guilty of fraud or dishonesty, punishable with a jail term of three months or more;

- the director has committed three or more filing-related wrongdoings under the CA in a time frame of 5 years;

- the General Division of the High Court has given the director 3 or more orders against him. Enforcing the instantaneous checking of the company’s registers, minutes or other documents under section 399 of the CA, or the requirement for filing returns under section 13 of the CA, within a time frame of 5 years; or

- 3 or more of the director's companies were struck off from the register by ACRA within 5 years (counting from the 3rd company's strike off date).

Disqualification notice

Once the director received the disqualification notice, he or she must present it to the company instantly. The company needs to report his or her disqualification to ACRA within 14 days from the date of disqualification.

What will happen if a disqualified director continues to act as the company's director?

You can lodge a complaint with ACRA if you believe that the director is still acting in the capacity as one, even though he or she falls into one of the categories for disqualification stated above. Anyone who has ample details of the company or the director can lodge the complaint.

You can send the complaint together with supporting documents (for example, court or bankruptcy orders) by post to ACRA. If the complaint is valid, the company must comply to remove the said director.

How long is the disqualification period?

The period of the disqualification depends on the reason(s) but in general, it is 5 years. An example is when a director is being disqualified for being director of at least three companies that have been struck off within five years, he or she is disqualified for five years. Starting from the latest company's struck-off date.

For companies that wind up on grounds of national security, the directors are disqualified for 3 years starting from the date of the winding-up order.

Whereas for conviction of offences, the start date of the disqualification depends on whether the sentence is imprisonment:

- If there is imprisonment, the disqualification will start on the date of conviction. It will continue for the next 5 years after the end of the jail term.

- If there is no imprisonment, he or she is disqualified for up to five years. Such disqualification will start from the conviction date.

What happens when the disqualification ends?

A person can be reappointed as the previous company's director or incorporate a new business entity instead. After the reappointment or the incorporation of a new company, the company shall notify ACRA of such appointment within 14 days from the reappointment date.

3. Resignation

A director can voluntarily resign from directorship. For Singapore context, a valid resignation requires that:

- The procedure for resignation is in compliance with the company’s constitution; and

- The company must have 1 remaining resident director in Singapore at the minimum.

Should I inform ACRA of the cessation of directorship?

Upon resigning from the directorship, companies need to file a cessation notice to ACRA. It must not be more than 14 days from the date of the change in directors, for example, the date of resignation or disqualification.

While informing ACRA, you need to prepare and submit certain documents like:

- For disqualification, the court order;

- For resignation, the notice of resignation by the director and also acknowledgement from the board.

There can be circumstances when the former director has to inform ACRA by himself or herself:

- If the former director believes that the particular company is unwilling or unable to do so; or

- If the former director found out that the current officers of the company failed to inform ACRA. This can happen when the corporate secretary had resigned as well and all other directors are debarred too.

What happens if I fail to inform ACRA?

If no notice of cessation is given, it will constitute an offence of non-disclosure under section 165 of the CA. Chief executive officers (CEOs) or directors can suffer liability personally and incur a fine of up to S$15,000 or a jail term of up to three years.

As long as the company and/or director fails to submit any notice to ACRA, the cessation is ineffective. This means that the director must continue to manage the company responsibly. If the offence is ongoing (i.e. did not give cessation notice to ACRA), the director can be fined SGD $1,000 daily, for as long as the offence is perpetuating.

What will happen to the shares that the director is holding?

Under the Model Company Constitution, the director needs to sell his or her shares to the company's existing shareholders.

If there isn't such a clause, the director can keep the shares that he or she is holding. But the director can also decide to transfer or sell off the shares.

Know-hows

Knowing the various essentials to remove a company's director will ensure that the entire procedure is legitimate. If ever you need to remove a director, they give you an insight into how you should draw up your constitution to prevent future complications.

Contact us

If you have questions on how you can remove a director from your company, do get in touch with us!

Download the Telegram app and follow us for the latest updates: https://t.me/sgcompanyservices

When The Company Goes Insolvent, What Can You Do As A Creditor?

As a creditor of a company that cannot pay its debt on time, or it probably has already become insolvent, the biggest question is 'what can I do to recover my money? This article helps to answer the question of when the company goes insolvent, what can you do as a creditor?

The company is still solvent

As a creditor, you can try to petition to wind the company up to realise the debts owed to you. You can do this through the submission of a winding-up petition in 2 ways:

- Creditor’s winding up: a company can decide to go for a voluntary creditors’ winding up if the company's director(s) have reasons to believe that the company cannot, by virtue of the liabilities, carry on its operations. When the company's management has initiated the wind-up process, all the creditors will have the right to go through with the resolution for the process of winding-up and take over control of the process for liquidation.

- Compulsory winding up: the company's creditors has decided to apply for the business to wind up because the company is insolvent and its management is not willing to wind up the business or the risk of the company dissipating its assets is high.

Initiating a compulsory winding up

To do so, you have to be a creditor (inclusive of a contingent or prospective creditor) of the company. Secondly, you need to establish that the company has no means to repay its debts.

There are normally 3 methods to prove that a company is insolvent:

- The company has failed to repay any sum of more than SGD $10,000 from within three weeks of a statutory demand served to the registered address of the company;

- The judgement execution in favour of you is still unpaid; or

- The company can no longer meet its liability on short notice or its liabilities against its assets is in excess.

The company is insolvent

If the company is already insolvent, you must submit proof of debt to the company. But it is not guaranteed that you will be able to recover the full sum of debt owed to you as there may be many other creditors like yourself who are claiming against the company that is insolvent.

Proof of debt

All debts in insolvent liquidation can be proved against the company that is insolvent. If your debt or claim is not possible to prove, you won't be able to receive any form of payment.

When the company undergoes liquidation, the liquidator will inform you in writing and broadcast the liquidation in advertisements. You have up to 3 months to file your proof of debt when the order of winding up is made. Current and future debt or contingent debt as at the date of liquidation or any interests due up to the date of liquidation can all be proven. Contingent debt refers to debt that will occur out of an existing legal obligation in an event that may or may not occur.

After that, the liquidator will examine and decide on all the proofs of debt he or she has received and will decide to either accept or reject. The liquidator may also require more evidence regarding these proofs.

In the event your claim has been rejected, you can appeal to the court. When you have failed to produce more evidence to the liquidator's satisfaction, your claim will be rejected or downsized.

Winding up effects

After the court has made a winding-up order, you are unable to start or continue any legal action against the company. You will need to first obtain permission from the court. The reason is to facilitate an equal and organised manner of distribution of the company’s assets amongst the unsecured creditors.

The court may grant permission to start legal action against the company that is insolvent if:

- To reclaim one’s own property (for example, equipment that is on loan); or

- To exercise remedy over the insolvent company’s property. For example, a landlord creditor seeking to reclaim the property cause of default in rental payment.

Secured creditors are unaffected by this and are allowed to claim any assets that are secured to the debts owing to them.

Recovering debts from a company

A lawyer can advise you on the steps you need to take in order to secure your position as a secured creditor through proper advice, as well as the steps to do as an unsecured creditor.

When the company is insolvent, there is a huge difference between whether an unsecured or secured creditor. A secured creditor has no worry of reclaiming the debt owed to him or her. Even in insolvency, you are not deprived of your interest in the asset.

Prior to getting into a high-risk investment, you can mitigate some insolvency risks involved by talking with a consultant or a lawyer.

If you have any further questions, get in touch with us today!

https://youtu.be/Ka5prMBU2C4

Download the Telegram app and follow us for the latest updates: https://t.me/sgcompanyservices

How to Change A Foreign Company into A Company Registered in Singapore through Re-domiciliation?

Owners of a foreign company should consider a re-domiciliation of their company to Singapore. It has a stable political scene, a pro-business environment, a competitive tax regime, and maintains strong economic ties to Asia and the rest of the world. It has potentially more advantages than the other methods of setting up, like setting up a Singapore branch of your foreign parent company or setting up a Singapore subsidiary. In this article, we will discuss the advantages of re-domiciling to Singapore, as well as the steps to doing so.

What is re-domiciliation?

When a company transfers its origin of incorporation from one country (jurisdiction) to another country, it is re-domiciliation. This is different from starting a branch office overseas or setting up a subsidiary in Singapore.

If the foreign company sets up a branch in Singapore, it is equivalent to carrying out business here. The foreign parent company is regulated by the jurisdiction of its home (original) country.

If the foreign entity incorporates a subsidiary in Singapore, they are two separate legal entities. The subsidiary has a unique legal existence from the foreign parent company and it can conclude contracts on its own. The corporate group needs to comply with the law of the country where the parent company resides and the Singapore law.

When you redomicile your foreign entity, you are converting the foreign-country-registered company into a company registered in Singapore. The foreign entity transfers all its rights and liabilities to the Singapore company. The redomiciled company in Singapore will be regulated by Singapore law from that effective date.

With effect from 11 October 2017, the Singapore government has allowed foreign companies to re-register as companies in Singapore under Part XA of the Companies Act (CA). The criteria to redomicile as a Singapore legal entity are detailed out further in the Companies (Transfer of Registration) Regulations 2017. We will discuss this in detail below.

Reasons for re-domiciliation to Singapore

Companies may redomicile for a variety of reasons – be it practical, business or legal.

Business continuity

Redomiciling can make sense from a business angle or decision. If a company changes its country of jurisdiction to Singapore, the company is effectively the same entity. Only the company's country of incorporation changes to Singapore from a foreign country.

This will allow for complete continuity of the existing business. All track records, goodwill and credit ratings remain untouched. This is useful when the re-domiciled company seeks credit from Singapore banks or applies for certain licenses from the authorities.

In the case of subsidiaries, the foreign parent company acts as a guarantor for the loans undertaken by its Singapore subsidiary. It also undertakes to share its expertise and control all operations of the Singapore subsidiary.

Tax advantages

Singapore taxes corporations at a much lower rate than most developed countries. Foreign companies can take advantage of this by shifting a part of their operations to a subsidiary in Singapore.

Many countries have begun to tighten their laws on the taxation of cross-border corporate groups in order to reduce base erosion and profit shifting. This is when a company tries to shift the profits earned by the parent company to its subsidiary company. As a result, those profits will be taxed at the (cheaper) rate of the second country, for example, Singapore.

An example...

Let us look at an example. Australia introduced a Diverted Profits Tax (DPT) of 40% for Significant Global Entities (SGEs) recently. An SGE is usually a corporate group with some Australian business operations, with an annual income of over AUD $1 billion globally. Under this new DPT legislation, if the Taxation Office in Australia has reason to believe that profits earned in Australia have been sent out of the jurisdiction to another foreign-related company as a form of avoiding of taxes arrangement, it can cause the Australian entity's profits to be liable for taxes twice (both in the destination country where such profits were diverted to and in Australia too).

In the case of re-domiciliation, the company will no longer be registered overseas. It subjects itself to Singapore law, instead of its original country of registration. The foreign company can avoid the liability risk of double taxation under tightened taxation legislation mentioned above.

If your company’s original country of registration imposes new regulatory requirements on your foreign company, like higher corporate tax, then redomiciling to Singapore can be an option to avoid such a situation.

Leveraging on Singapore’s numerous Free Trade Agreement (FTA) memberships

Redomiciling your operations to Singapore allows your company to take advantage of the multiple FTAs Singapore has with other countries. This can greatly boost your profits for the company by saving costs.

Committing to conducting business in the Asia-Pacific region

The irreversible process to redomicile here in Singapore (take note that no provisions are given for Singapore registered companies to redomicile to a foreign country), will send a critical signal to major clients and potential clients of yours, that your foreign company is genuine about concentrating on Singapore (or Asian) commercial activities.

All legal rights and liabilities will be transferred to the new Singapore company

From a legal point of view, redomiciling is more direct than setting up a Singapore subsidiary. Major contracts mostly have clauses for non-assignment. Although obtaining permission for assigning contracts within the same corporate group is fairly easy, re-domiciliation will simplify the entire process because all rights and liabilities will be transferred over to the Singapore entity, which is effectively the same legal entity as the overseas registered company originally.

Credit facilities from the original country of registration may be able to bring over to the redomiciled (Singapore) company but it is best to negotiate this directly with your company's bank.

Eligibility for re-domiciliation to Singapore

Before your application to redomicile your foreign company to Singapore, you need to check if your company’s name is acceptable for incorporation in Singapore. Even though you will want to select the same company name as your foreign company, this could be impossible if there is an existing Singapore company name that is similar to yours.

Three criteria to check for eligibility are solvency, legality and size.

Solvency

Your foreign company must be capable of paying its debts when they are due over the next 1 year starting from the date of application for re-domiciliation. It cannot be in liquidation, or receivership or any other equivalent form of winding-up process.

Your company assets must be more than liabilities, which simply means your net asset value (NAV) must not be negative.

Legality

Next is legality. You must be in compliance with all relevant company laws in the original country of your registered company. Also, you are not looking for re-domiciliation in Singapore for some illegal purpose, for example, to defraud your creditors.

Most importantly, your country of registration must have the legal provisions in force for companies to redomicile overseas. Some countries allow two-way re-domiciliation, which means foreign companies can re-register as local companies, and vice versa again. These countries are mainly Canada, the British Virgin Islands (BVI), Australia and New Zealand.

Other countries such as Singapore, the United Kingdom and Hong Kong, only allows inward re-domiciliation. That means foreign companies can register as local companies, but once done, they cannot re-register as foreign companies.

Conversely, if your foreign company is moving from a common law judiciary system to another one, the basic company law structure will most likely be similar. Hence, concepts that you are familiar with, such as directors’ duties, will continue to be applied in some manner when your foreign company has been redomiciled as a Singapore company.

Size

Finally, your foreign company has to meet the size criteria. Your company must meet at least 2 out of the 3 following criteria:

- 50 employees minimally

- More than SGD $10 million in revenue per annum

- More than SGD $10 million worth of total assets

If you wish to redomicile the corporate group as a whole, then the group has to meet the size criterion.

How can I redomicile my foreign entity to Singapore?

In order to redomicile your foreign company to Singapore, you have to submit an application form for Transfer of Registration to the Accounting and Corporate Regulatory Authority (ACRA), which is the Singapore regulatory body for companies. Under the CA, your application must be accompanied with:

(1) A certified true copy of your Memorandum of Association (also known as Company Constitution) or equivalent company constitutional documents.

(2) A copy of the company constitution you plan to use when you have successfully redomiciled as a Singapore company.

Although you probably can adopt your existing company constitutional documents almost entirely if it was incorporated in some other common law judiciary system, there might be certain parts of the Singapore law that will mean additional clauses have to be added in.

An example would be all companies in Singapore must include an “objects clause” in their company's constitution. This clause states the purpose of the company, meaning, all the proper areas of business. The existing foreign company's constitution may or may not have this objects clause as certain countries have a default ruling that all companies have no restrictions.

(3) The relevant documents needed are:

- A certified true copy of your overseas certificate of incorporation or the equivalent

- A signed written document issued by all current company directors declaring that the foreign company fulfils the solvency criteria (as explained above)

- From each individual proposed director, a written declaration:

- of his/her consent to continue as a director upon re-domiciliation

- that they are not disqualified or barred from carrying out duties as a director in Singapore.

- of their intention to take up a certain number of shares in the company after re-domiciliation, if they do not currently own any company shares

- A written consent from each proposed company secretary declaring:

- their consent to act as the redomiciled company’s secretary

- they are not barred from acting as a secretary

- If the foreign company is planning to redomicile as a public company, they must have the required professional or qualifications to be a secretary of the redomiciled public company (usually a qualified lawyer, accountant, or a member of the Singapore Association of the Institute of Chartered Secretaries and Administrators [SAICSA])

- A confirmation statement from the lawyer or the filing agent handling the re-domiciliation process, stating the proposed director's consent to act as the company's director, and the proposed secretary's consent to act as the company's secretary.

(4) Fees.

Currently is SGD $1000 and also non-refundable.

What is next after re-domiciliation in Singapore?

After you have submitted your application, the next step is obviously either approval or rejection by ACRA.

Although it is fairly straightforward if you meet the criteria, ACRA does have a reserve power to reject applications for re-domiciliation on certain public policy grounds. If it happens, your company can appeal to ACRA and to Singapore's Minister of Finance.

Once your application is accepted, your company is now a company registered in Singapore. It adheres to Singapore company law like any other company which has originally registered in Singapore. You have the duty to de-register your foreign company in its original country, not more than sixty days and submit such evidence to ACRA. A deadline extension can be obtained from ACRA, but it is best to resolve this matter as soon as possible.

Besides that, you also have a duty to make sure that all pre-existing charges are to be registered not more than 30 days from the date of re-domiciliation. If a bank has a floating charge over the assets of the company, this charge must be duly registered. Your company's directors will be liable for punishments such as fines if this is not in compliance.

After completing all these steps, you can move on to the next phase and finally benefit from the new status as a registered company in Singapore.

Other factors

Re-domiciliation to Singapore is an irreversible decision. Currently, Singapore registered companies cannot redomicile overseas. As more countries introduce re-domiciliation schemes, companies have more options over which countries are more suitable for their business growth.

Re-domiciliation is a relatively new process. As such, foreign entities considering to redomicile to Singapore ought to consider carefully before actually doing so. Seek advice from lawyers and tax specialists in your original country of registration, to prevent possible liability to your company in terms of stamp duty if this amounts to a share sale in your local law. Likewise, it is prudent that you get advice from lawyers and tax specialists in Singapore.

Get in touch with us today!

To conclude, Singapore has an attractive business environment that overseas companies with operations in Asia can thrive in. If you like to commence your re-domiciliation of your company to Singapore, get in touch with us today!

Download the Telegram app and follow us for the latest updates: https://t.me/sgcompanyservices

How To Set Up Singapore Representative Office As A Foreign Entity?

A Representative Office (RO) is a temporary administrative office that serves as a point-of-contact to organise and execute non-commercial activities, for the foreign company or entity. In this article, we talk about the benefits steps to set up a Singapore Representative Office (RO).

The RO does not have any legal status and is not a separate legal entity from the parent company in the eyes of Singapore courts.

Benefits of setting up an RO in Singapore

Whenever a foreign company plans to come into Singapore, the manner of entry is usually determined by its commercial objectives.

The RO helps the foreign company to find out more about potential business opportunities in Singapore or the Asia-Pacific region.

The foreign company does not need to commit to any financial outlay yet. It can also conduct certain non-commercial activities to determine its own future business opportunities in Singapore.

How can a foreign entity decide whether to set up a branch office, subsidiary or re-domiciliation instead of an RO?

An RO is only allowed to operate in Singapore for not more than 3 years, after which should the foreign entity can decide to begin its operations by setting up a subsidiary, a branch office or re-domiciliation here in Singapore.

Below we explain the differences between the four options:

- A branch office is basically an extension of the foreign parent company. They are not separate legal entities. Different from an RO, branch offices can conduct business activities but can only conduct the same type of activities as the parent company. The foreign parent company is a non-resident for planning to achieve market share in the short term.

- A subsidiary is a company incorporated in Singapore that is owned or controlled by its parent company, meaning the parent company holds the majority of shares of the subsidiary. Different from an RO, subsidiaries can conduct all types of commercial activities, even if it is of a different type from their parent companies. This is the best option if foreign companies are planning to operate in Singapore for the long term.

- Redomiciliation is basically a procedure where the foreign company will transfer its registration from its country of incorporation to Singapore. This means that effectively the foreign company would become a Singapore incorporated company. This option is for any foreign company that decides their future prospects would be for the better if it relocates here instead.

Requirements

Scope of approved activities of an RO

Like we mentioned earlier, an RO is just a temporary administrative office with no official legal standing, it is not allowed to engage in commercial or profit-yielding activities. So an RO cannot sign any contracts, issue Letters of Credit (LOC), negotiations or any forms of trading.

ROs are only allowed to carry out activities such as market research and feasibility studies. For example, the RO can take part in trade conventions, collect information about potential clients and target markets, research market demand and handle inquiries.

If the RO fails to work within these criteria, it can be de-registered.

Must the RO be operating under the same name?

The RO has to conduct its activities under the same company name as the foreign company, except that it must include the words or term “Representative Office”. It must be reflected on the signboard, name cards of staff and all other marketing materials.

Criteria for application

A foreign entity that plans to set up an RO in Singapore:

- Must be incorporated for more than 3 years; and

- Have achieved sales revenue of no lesser than USD $250,000.

Besides the above, an RO must appoint a Chief Representative Officer (CRO) who must relocate to Singapore from the foreign company’s head office and oversee all of the activities by the RO. And it can only employ a maximum of 4 employees as support staff.

How to set up a Singapore RO?

The foreign entity can engage a Singapore professional corporate secretarial firm to help with the setting up. Your corporate secretary can facilitate via online, or courier the physical documents over.

It is not necessary to send a representative to Singapore, from a foreign entity just for the setting up of the RO.

Application through the Monetary Authority of Singapore (MAS)

If the RO’s business activity is in the sector of finance, banking or insurance industry, it must be registered with MAS.

Before registering the RO, applicants should first contact the Banking Department at MAS to present their plans to MAS before they submit a formal application. The purpose is to ensure that the foreign company has a proper assessment of the chances of the proposed application.

The list of documents needed for the formal approval process with MAS are:

- A completed application form (can be found on MAS’ website);

- Original letter from the foreign country’s relevant authority showing the approval of the setting up of the office in Singapore;

- A certified true copy of the company’s constitution also known as Memorandum and Article of Association;

- Annual financial reports of the foreign entity for the past 2 years, balance sheet and profit and loss statements dated within 3 months before the application date; and

- Annual reports of the holding company who is controlling the bank account or beneficial owners with controlling interests for the most recent financial year (FY).

Application through Enterprise Singapore

As for ROs in other industries, the registration can be done with Enterprise Singapore instead. The documents required for approval are:

- A completed application form;

- A copy of the foreign company’s Certificate of Incorporation; and

- The parent company’s latest annual report and audited accounts (copies will be accepted)

For all non-English documents, an official English translation must be provided together with the application.

The processing fee for incorporating an RO and renewal of the RO per annum is SGD $200. This fee is non-refundable in the event of withdrawn or unsuccessful applications.

You can pay via:

- Cheques (crossed and payable to Enterprise Singapore);

- Credit cards (Visa or Master) via Enterprise Singapore online portal; or

- Bank Drafts (payable to Enterprise Singapore in Singapore currency/SGD).

How long does it take to register?

After submitting the application, it takes about 7 days for the authorities to issue a Letter of Approval (LOA), confirming the registration, subject to approval by the authorities. If they need additional documents or any further clarifications, the approval process can extend by 7 to 14 days.

What happens next?

What is the duration an RO can operate?

An RO will only be to operate for a period of not more than 3 years in Singapore. As such, the RO status must apply for renewal during this 3-year period annually.

The authorities will normally send a notice 2 months prior to the expiry date via post or email. If there is no response, they will proceed to de-register the RO.

After that, the foreign company will need to incorporate a branch office or subsidiary if it wishes to continue its business activities in Singapore.

Application of an Employment Pass (EP) for foreign staff

In order for a foreign staff (i.e the CRO, see above) to be able to work in Singapore, the foreign company must make an application for an EP.

The EP is basically a work visa that will allow foreign staff to work and live in Singapore. It is usually valid for 1-2 years and has to be renewed afterwards.

You need to provide the documents listed below for application:

- Copy of the approval letter by either MAS or Enterprise Singapore for the set up of an RO in Singapore; and

- A letter from the RO’s foreign entity stating:

- The reason and purpose of the application for EP

- The time period of the foreign staff’s assignment

- A guarantee for the repatriation and maintenance of the foreign staff while working and living in Singapore

For more information on the procedures of applying for an EP, please refer here.

Will the RO be liable to pay corporate tax?

The RO will not have any form of liability in corporate tax in Singapore because the RO is not allowed to even generate income.

Will the RO be able to open a corporate bank account?

The RO can open a corporate bank account in Singapore for the purpose of running its operations. This usually takes 14 working days.

Opening a corporate bank account may sometimes require a physical interview with the stakeholders to conduct the bank's due diligence checks. These checks comprise a detailed appraisal of the purpose, background and finances of the foreign company’s business.

Under what situations will the RO need to de-register?

If the RO turns dormant, meaning it stops carrying out activities for a period of time, it needs to de-register.

ROs need to de-register once the foreign parent companies become dormant, meaning the foreign company does not have any more revenue or income within a financial period.

Contact Us

If you need help in setting up your company in Singapore or you have any questions, please do not hesitate to contact us.

Download the Telegram app and follow us for the latest updates: https://t.me/sgcompanyservices

How to Register A Singapore Branch Office

Singapore is and has always been one of the most business-friendly countries in the world. The location is strategic for companies that are looking to launch their expansion into the Asia-Pacific region. In this article, we discuss how to register a Singapore branch office and its benefits.

Foreign companies planning to begin operations in Singapore can choose from a few options. They can operate through an offshore company, a Singapore representative office, a Singapore branch office or just incorporate a new subsidiary.

Why register a branch office?

Similar to a subsidiary, a branch office allows the foreign company to begin their business operations in Singapore. The foreign company can generate profits and also hold properties in Singapore.

Unlike a subsidiary, a branch office is an extension of the foreign company, instead of a different legal entity. The branch office must share the same name as the foreign entity, and sign any contracts under the foreign entity’s name. The purpose is to enable the branch office to leverage its foreign company’s brand to do contract tendering and get financing in Singapore.

The fact that a branch office is not a separate legal entity, brings about a number of disadvantages. They are:

- The lack of limited liability: The foreign company is liable for all debts and contracts that the branch office incurs and signs respectively.

- Non-tax-resident: The branch office is not a tax-resident in Singapore, not unless the foreign company operates locally in Singapore. It means that a branch office will be ineligible for tax exemptions on its profits. You can refer to our article about the benefits of Singapore tax residency.

- Limited activities: The branch office will not be able to carry out business activities that the foreign company is unable to undertake. For illustration, if the foreign company’s constitution or by-laws disallow it to carry out certain business activities, the branch office will also be restricted to the same business activities.

However, a branch office is still useful for a foreign company to establish its business in Singapore for a start. It allows the foreign company to undertake contracts under its own brand name. At the same time, to leverage its existing brand image and reputation.

Establishing a branch office in Singapore

You can register branch offices in Singapore online through the Accounting and Corporate Regulatory Authority (ACRA).

Foreign companies will need to engage the services of a registered filing agent such as a corporate secretarial firm in Singapore to help with the registration.

The corporate secretarial firm must obtain all the necessary documents for submission to ACRA:

- The name and registered office of the foreign company in its country of jurisdiction

- A certified true copy of the certificate of incorporation of the foreign entity

- A certified true copy of the constitution (memorandum of articles) of the foreign company

- A notice of its registration number, business description and legal entity type

- Personal particulars of all the directors in the foreign company

- Personal particulars of at least 1 Singapore resident, who is the authorised representative of the Singapore branch company

- Written consent of appointment by the authorised representative of the branch company

- Details and operating hours of the branch office here

- The most recent audited financial statements of the foreign company (if required under the laws of the country of incorporation)

Besides the above requirements, the corporate secretary may also request its own documentary requirements from you.

The registration process generally takes 2 to 14 working days after submission. However, it may take longer if it is referred to the Registrar or other government agencies for additional checks and approval.

An example would be if the foreign company is planning to open a branch office to offer medical services in Singapore, its application will be referred to the Singapore Ministry of Health (MOH) for approval. A list of industries where authority approval is needed can be found here.

What's next after setting up a branch office?

Once successful registration, the branch office can begin operations in Singapore. But certain licences may still be needed before it can carry out some business activities, such as the opening of a restaurant. Most licences are applied through GoBusiness, a one-stop Singapore government portal.

The branch office must apply for the relevant employment passes or permits if it plans to transfer some foreigners to work here in Singapore.

The branch office can decide to either open a new corporate bank account here in Singapore or use the same foreign bank account as the head office.

Do note that the foreign company (head office) must comply with all existing filing requirements of its financial statements with ACRA. On top of that, it must prepare the submission of its audited financial statements of the branch office in Singapore. Hence we highly recommend that you set up a new corporate bank account for the branch office.

Closing of a branch office

When the branch office no longer has a place of business or has ceased business operations within seven days of such cessation in Singapore, you can shut it down by notifying ACRA. Such situations arise when the foreign company enters into liquidation in its country of incorporation.

The authorised representative (nominee director) of the branch office can apply to ACRA to strike off the branch office from the register in the situations below:

- The sole authorised representative or nominee director wishes to terminate his service but is unable to due to the foreign company's failure to either respond or appoint a new authorised representative within a period of 12 months, starting from the date of the resignation notice.

- The only authorised representative has asked for instructions for the closing of the branch office but the foreign head office has failed to give any instructions within a period of 12 months from the date of such request.

In the absence of an authorised representative, the application for striking off can be filed by the corporate secretary.

Common questions

1. Who can hold shares in a branch office?

As stated earlier, a branch office is just a simple extension of the foreign entity, thus there is no separate set of shareholders. The shareholders of the initiating foreign entity in essence own the branch office.

2. Do I need to be physically present in Singapore for the setting up of a branch office?

Physical presence in Singapore is not necessary to set up a branch office. Many corporate secretarial firms such as ours are capable of incorporating online.

The setting up of a corporate bank account in certain cases may require a physical presence on a case by case basis.

3. How to register for corporate tax?

A branch office will be registered with the Inland Revenue Authority of Singapore (IRAS) automatically for corporate tax purposes once its incorporation is completed with ACRA. The branch office must register for Goods and Services Tax (GST) with IRAS if the taxable annual turnover is more than SGD $1 million.

4. What are the tax rates?

All companies, including branch offices, are subjected to a flat corporate tax rate of 17% on their taxable income. If their annual taxable turnover exceeds S$1m, they incur a 7% GST on their business purchases.

5. Can I send the profits of the branch office back to the foreign (head) company?

Singapore has no major restrictions on remittances or capital movements (i.e. transferring of funds in and out of Singapore). A branch office is an extension of its foreign entity. Thus, the branch office is free to remit its profits and capital back to the foreign entity.

Incorporating a branch office is a fairly straightforward process in Singapore. It can be an attractive option for foreign companies looking to set up their business here.

Contact Us

If you need assistance in setting up a branch office in Singapore, do get in touch with us today!

Download the Telegram app and follow us for the latest updates: https://t.me/sgcompanyservices