Forming a Singapore company

A company is a separate, distinct legal entity from its shareholders and directors. In other words, it is like a child who is considered a different ‘thing’ from his or her parents. There are mainly two forms of companies, public and private. In this article, we will explain to you how to start a Singapore company and the various options you can start one.

Public companies normally have at least 50 shareholders and are listed with the Singapore Stock Exchange. Conversely, private companies can have up to a maximum of 50 shareholders and are not listed. The shareholders are the beneficial owners of the companies. Therefore, they are responsible for appointing directors to help them run the company. In accordance with the Singapore Companies Act (CA), any local or foreigner above the age of 18 is allowed to incorporate a company in Singapore.

Why start a company?

Unlike sole proprietors and partnerships, the shareholders of companies have limited liabilities. Companies are separate legal ‘bodies’ from the owners. Therefore, owners/shareholders are not personally liable for the debts of the company, or any legal action against the company in normal circumstances. However, in certain special circumstances, owners/shareholders can be liable for the debts of the company.

Companies have more legal requirements to comply with in comparison. For example, failing to file annual returns and/or to hold annual general meetings, can result in penalties. These penalties are imposed by the Accounting and Corporate Regulatory Authority (ACRA). In addition, there is more work to wind up a company too. It can take up to 5 months to remove a company from the register.

A company structure is the most suitable if you wish to grow your company. Compared to other models, the company structure makes raising capital and transferring ownership easier. To find out more, you can read up the various business models in Singapore here.

Things to note before registration

Directors

At least 1 director residing in Singapore is required to be appointed. By definition, any individual who is a Singapore citizen, Singapore Permanent Resident, or holds an EntrePass, Employment Pass, Dependant’s Pass, fulfils the requirement of residing in Singapore. A Singapore company can appoint as many local or foreign directors as it chooses. To qualify as a director, the appointee must be at least 18 years old, not bankrupt and have no prior conviction of any malpractice. A director need not be a shareholder and vice versa.

Shareholders or members

Singapore private limited companies must have at least 1 shareholder and not more than 50 shareholders. A natural person (individual) or another legal entity (company or a trust) can be a shareholder. Singapore companies can be either 100% local or foreign-owned. Also, existing shares are transferrable or you can issue new shares to another person after the company has been incorporated.

Corporate secretary

Per the Company act, all companies must appoint a qualified corporate secretary within 6 months after incorporation. Like the directors, a corporate secretary has to be a natural person (individual) who is living in Singapore. An important note is that where there is only one shareholder/director, that person is not allowed to be the corporate secretary.

Paid-up capital

The minimum paid-up capital to incorporate is S$1. Subsequently, you can increase the paid-up share capital anytime after incorporation.

A registered address

A Singapore address must be used as the registered address of the new company. In other words, it can be either a commercial or residential address as long as it is a physical address and not a P.O. box. For instance, Singapore residents can use their home address as their company’s registered address under the Home Office Scheme. Similarly, this scheme applies to private properties as well.

Owners/occupiers should check their eligibility and obtain HDB’s approval. For private residential property owners, they have to get approval from Urban Redevelopment Authority. Most importantly, the registered office in Singapore has to be accessible and operational during office hours to the public.

Company tax

The tax rate in Singapore for companies is 17%. On top of that, Singapore companies get extremely attractive tax incentives and exemptions. A newly incorporated company can get tax exemptions on its first S$200,000 chargeable income. Above all, there is no capital gains nor dividend taxes for Singapore registered companies. Click here for our guide to corporate tax in Singapore.

Documents needed

For company incorporation, ACRA requires the following information:

- Choose an ACRA approved company name

- Description of company’s activities

- All shareholders’ particulars

- All directors’ particulars

- The registered address of the company

- The corporate secretary’s particulars

- Company constitution

- The company’s proposed fiscal year-end date

Incorporation

Company registration is processed online in Singapore. Usually, the incorporation takes 1 to 2 days. Fortunately, you need not be present in Singapore to register a company if you do not reside in Singapore. However, it is advisable to engage the services of a registered filing agent such as us to do so for you.

1. Choosing an approved name and address

To incorporate a company in Singapore, you must first choose an approved name by ACRA. To know how to do so, read our other article here.

Normally, the result of the incorporation is within an hour approximately. However, if the proposed company name has certain sensitive words, the name approval may take up to a few days.

Ensure that the proposed company name:

- Not identical or similar to any existing Singapore companies’ names

- No infringement of any trademarks

- Not vulgar or offensive

- Not under reservation

You can reserve the proposed company name for up to 60 days from the date of application. If need to, you can apply for an extension before the expiration date for another 60 days’ validity.

2. Adopting company’s constitution

Every company must have a constitution. It is a legal document that defines the rules and regulations on how the company is governed. It also details its structure, shareholder rights and all other rules for the management of the company.

If you wish to avoid hefty legal fees to draft your constitution from scratch, you can adopt the model constitution found here.

3. Completion of registration

Once you have completed the above steps, you can finalise the registration. In order to do that, you need to fill in key information like company shareholders details, and the personal particulars of all directors and officers. In the case where the company’s purpose is to set up a school, the incorporation process will take from 14 days to 2 months.

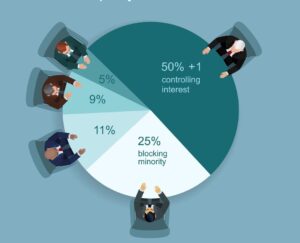

Shareholder agreement

Besides the company constitution, a shareholder agreement is also an important legal document for the incorporation. This document sets the rules and regulations for managing the company. In addition, it also details the relationship between all parties such as the shareholders and directors. A shareholder agreement supplements the company constitution by covering specific situations. Moreover, it serves to resolve any form of disputes should they arise.

Documents issued after registration

ACRA will give you a few documents upon successful incorporation of the company:

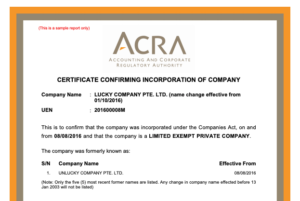

1. Certificate of Incorporation

After successful incorporation, ACRA will send an official email notification confirming the registration which includes the unique entity number (UEN) and serves as the official certificate of incorporation. ACRA no longer issues a hard copy of the certificate as its no longer required. If you prefer a hard copy, you can submit a request online where it is chargeable.

2. Business profile

Generally, you can download the business profile within an hour after successful registration and it contains:

- Company name and UEN

- Previous known names for the company (if applicable)

- Date of incorporation

- Principal business activities

- The paid-up share capital

- Registered address

- Shareholders’ particulars

- Directors’ particulars

- Company secretary’s particulars

These two documents are sufficient in Singapore for all contractual and legal purposes. Some of these purposes include the opening of corporate bank accounts, signing of a rental lease, subscription to internet providers.

Maintenance fees of a company

After registering your company, you will incur certain fees on an annual basis to ensure compliance with the authorities. Do note, any late filing or compliance omissions can result in fines and penalties for the company.

Contact Us

If you have any questions at all regarding the setting up of a company in Singapore, contact us today!

Download the Telegram app and follow us for the latest updates: https://t.me/sgcompanyservices