Enhanced Jobs Growth Incentive - Up To 50% Salary Support For All New Local Hires.

What Is Jobs Growth Incentive (JGI)?

The jobs growth incentive in a job creation initiative by the government to promote the hiring of locals. (Locals refers to Singapore citizens and Singapore permanent residents).

When the employer increases their local hires over the period in February 2021, the employer is eligible for a support of 25% (or 50% for mature local hires aged 40 and above, persons with disabilities or ex-offenders) of the first S$5,000 gross monthly wages payable to the new local hires.

The S$5,000 gross monthly wage cap will be further increased to S$6,000 for mature local hires aged 40 and above, persons with disabilities or ex-offenders starting March 2021.

The JGI support will be for up to 12 months for non-mature local hires and 18 months for mature, persons with disabilities or ex-offender local hires. The count starts from the month of hire.

If the employer fails to retain their existing local employees during the qualifying period, their JGI payout will be reduced.

Who Is Eligible for Jobs Growth Incentive?

In order to be eligible, the employer must fulfil ALL of the following:

- The employer is created on or before 15th February 2021

- There must be an increment in the total local workforce

- Increase in local employees earning of gross wages of at least S$1,400 per month

The employer must continuously fulfil the above criteria and make CPF contributions timely in order to get the full JGI payout.

How Do I Apply For JGI Payout?

The employer need not do anything. The inclusion and payout is automatic. JGI payouts will start from March 2021, payable in 10 trenches till Jun 2023.

Looking for local hires for your company? Before you start, know all the various hiring grants you might be eligible for! Come talk to us today!

For all HR matters, be sure to engage the help of a MOM licensed employment agency.

Download the Telegram app and follow us for the latest updates: https://t.me/sgcompanyservices

How To Register A Trademark For Your Singapore Business?

What is a trademark?

A type of intellectual property that represents your business, products, or services (think Macdonald's) is what we call a trademark. Trademark can be an important tool to help build brand loyalty, image and prevent competitors/imitators from stealing your market share. Armed with a registered trademark, you can even consider licensing the right of use to a third party, like a franchise, or to sell it in exchange for potentially a large sum of money.

Registered trademarks in Singapore are governed by the Trade Marks Act (2005 Revised Ed) (Cap. 332) together with its subsidiary legislation which consists of the Trade Marks Rules and Trade Marks (International Registration) Rules.

What does the trademark comprise?

To be precise, the trademark you registered only grants a statutory monopoly in Singapore. After which, it will be in effect for 10 years and you can renew it indefinitely. If you wish to protect your trademark outside of Singapore, then you have to file applications in those countries concerned. You can do so either individually to those countries' trademarks offices, or via the Madrid Protocol.

For a trademark to be registered, it has to be capable of being represented graphically and distinct. In addition, consumers are able to distinguish your goods and/or services from other competitors' similar goods and/or services.

An individual or company can claim to be an owner of a trademark. They can file for trademark registration as long as they intend to use the trademark in the course of their business. There is no restriction or discrimination with regards to certain nationalities or status of residency. However, the applicant must provide the Registry of Trade Marks with a service address in Singapore.

Process Of Applying For Trademark In Singapore

Wish to know more about how you can apply for a trademark for your Singapore business? Our experienced team can help. Get in touch with us today!

Download the Telegram app and follow us for the latest updates: https://t.me/sgcompanyservices

如何申请新加坡学生准证

一般来说,想要在新加坡留学的外国人需要申请学生准证。在申请学生证之前,首先他必须已经被确认注册在新加坡任何一个被批准的全日制课程。夜校、周末和兼职课程是不被允许的。

学生证申请成功后,如欲转学,得需重新申请过。年满12岁零天或以下者,须向新加坡保健促进局提交疫苗接种资料。

申请时需要准备的文件

- 学校的入学确认信

- 护照证件生物数据页

- 个人资料包括居住过的国家、教育背景、工作经历和经济情况

- 最近亲属的个人资料(如有)

- 在新加坡的居住地址和联系方式

- 电子邮件地址

- (近3个月以内) 近照 (护照尺寸、数码、彩色)

外国人可以报考的教育机构类型

- 认可私立教育机构

- 外国系统学府

- 政府、政府资助、独立学校

- 工艺教育局

- 幼稚园及托儿中心

- 高等教育机构例如大学

申请不同的校园,那申请的条件和程序也不一样。详情请继续阅读下文。

认可私立教育机构

外国人只能就读在有 Edu-Trust 认证的私立教育机构。这些教育机构必须给学生所支付的学费做出保障。

一经批准,原则上批准函将说明这位外国学生是否需要支付保证金。这笔保证金必须使用银行保函来支付。

- 孟加拉国、缅甸、中华人民共和国和印度 —— 每位学生须保5000新元

- 印度尼西亚、菲律宾和泰国 —— 每位学生须保1000新元

- 其余: 每位学生须保1500新元

这名外国学生可以免除支付保证金,如果他是:

- 马来西亚或文莱公民

- 持有有效的直系亲属证、长期探访证或工作准证

- 新加坡公民或永久居民的子女或配偶

- 参加任何 Edu-Trust 认可的私立教育机构全日制课程

- 在一所 Edu-Trust provisional 私立教育机构读全日制攻读大学或研究生课程,但伦敦大学课程除外

- 在申请学生准证时,年龄在16岁以下

在离开新加坡之前,如果没有违反保证金中规定的任何条件,已支付的保证金将被全额退还。从学生通行证注销或到期开始,退款流程大约需要6周的时间。

外籍学生不需要亲身在新加坡办申请手续。申请人可于开课前最少2个月至不超过3个月在网上递交申请。

年满19岁的中华人民共和国公民,如欲攻读语言、商务、职业或美术非研究生学位课程或研究生学位课程,可能需要参加在北京的新加坡大使馆的面试。

新学生准证的一般处理时间约为4周。

外国系统学府

外国学生必须只进入 Edu-Trust 认证的外国系统学校。

外籍学生不需要亲身在新加坡办申请手续。申请应在课程开始前的至少4周在网上提交。

一般申请的处理时间为5个工作日。

政府、政府资助、独立学校

同样的,外籍学生不需要本身在新加坡办申请。申请应在课程开始前的至少4周在网上提交。

外国学生如果申请就读政府学校、政府资助学校或私立学校,他们必须有当地的担保人。当地担保人必须是年满21岁的新加坡公民或新加坡永久居民。

一般申请的处理时间也是5个工作日。

工艺教育局

外籍学生不需要在新加坡亲身办申请。同样的,申请应在课程开始前的至少4周在线上提交。

外国学生如果申请就读政府学校、政府资助学校或私立学校,他们必须有当地的担保人。当地担保人必须是年满21岁的新加坡公民或新加坡永久居民。

如果学生的父母或继父或继母是新加坡公民或永久居民,那他或她必须作为当地的担保人。

一般申请的处理时间同样也是5个工作日。

幼稚园及托儿中心

申请进入幼儿园或托儿中心的外国儿童必须确保学校拥有幼儿培育署 (Early Childhood Development Agency) 的许可准证。

申请必须在课程开始前的至少2个月,至不超过3个月在线上完成。

一般的处理时间是2个星期。

高等教育机构例如大学

一旦被录取为全日制学生,外籍学生将需要申请学生准证。

以下是符合条件的高等教育机构的名单:

- 本地大学

- 本地理工学院

- 在当地设有分校的海外学院

申请人不需要本身在新加坡。可以在课程开始前的至少1个月至不超过余2个月在线上提交。一般处理的时间为5至10个工作日。

豁免条件

外籍学生可获得豁免申请学生证,如果他拥有一下的其中任何一个条件:

- 入境豁免令,或者

- 在新加坡入境局获得短期探访通行证,希望参加短期课程,或者

- 拥有直系亲属证

准备开始寻找一所在新加坡留学的学校

我们的公司持有完整的职业介绍所执照,并有充分的知识与经验来帮助您或您的孩子在新加坡留学。

我们可以帮助您处理整个过程。从学校选择,注册到您所选择的学校,为你的全家人申请相关签证的整个过程,以及提供相关的协助搬迁到新加坡。

下载 Telegram 应用程序以关注我们的频道,获取最新的资讯: https://t.me/sgcompanyservices

How To Apply For Singapore Student Pass

This written guide serves to help you understand how you can apply for a Singapore Student Pass to pursue studies here in Singapore.

Before applying for a Student Pass, you need to enrol on any approved full-time courses in Singapore. Weekends, night classes and part-time courses are not qualified.

A new application will be required, if the student wishes to transfer to another school after approval of the student pass is granted.

For those aged 12 years 0 days or below, will need to submit their vaccination information to Singapore Health Promotion Board (HPB).

Documents To Prepare Before Application

- The Registration Acknowledgement Letter from the school

- Travel document biodata page

- Personal information including past countries of residence, education background, employment history and financial support

- Next of kin’s personal information (if any)

- Residential address and contact details in Singapore

- Email address

- Recent passport-sized, digital, colour photograph (not older than 3 months)

Types Of Education Institutions Foreigners Can Enrol For

- Approved Private Education Institutions

- Foreign System Schools

- Government / Government-Aided / Independent Schools

- Institutions of Technical Education (ITE)

- Kindergartens and Childcare Centres

- Institutes of Higher Learning (i.e. tertiary)

The requirements and procedures are different for each educational institution applied. Read on for more information on each educational institution.

Approved Private Education Institutions (PEI)

Foreigners can only enrol in EduTrust-certified private education institutions. These education institutions must offer protection of course fees paid by students.

The In-Principle Approval (IPA) letter will state whether the foreign student needs to pay a security deposit. The foreign student needs to pay the deposit with a Banker’s Guarantee.

- Bangladesh, Myanmar, People’s Republic of China and India - S$5,000 per student

- Indonesia, Philippines and Thailand - S$1,000 per student

- Others - S$1,500 per student

The foreign student may be exempted from paying a security deposit if he/she is:

- A Malaysia or Brunei citizen

- Holder of valid dependant’s pass (DP), long-term visit pass (LTVP) or work pass

- Child or spouse of a Singapore citizen (SC) or permanent resident (SPR)

- Attending a full-time course at an EduTrust-accredited PEI

- Doing full-time graduate or postgraduate university programme with the exception of the University of London (UOL) tuition programmes, at an EduTrust-provisional PEI

- Under the age of 16 years old at the point of application for the Student’s Pass

The security deposit will be fully refunded upon departure from Singapore if none of the conditions stated in the security bond is breached. It will take about 6 weeks to process the refund from the time of cancellation or expiry of the Student’s Pass.

The foreign students need not physically be in Singapore for the application. The application must be submitted online at least 2 months and not more than 3 months before the course commences.

*Citizens of the People’s Republic of China above the age of 19, who wish to attend a commercial, language, fine arts or vocational non-graduate or postgraduate degree course may need to attend an interview at the Singapore Embassy in Beijing.

4 weeks is the standard time for processing a new Student’s Pass.

Foreign System Schools

Foreigners can only enrol into an EduTrust-certified Foreign System School.

The same as approved PEI, the foreign student need not be in Singapore physically for the application. Such application must be submitted at least 4 weeks before course commencement online.

The standard processing time is 5 working days.

Government / Government-Aided / Independent Schools

The same requirements for Foreign System Schools, the foreign student need not be in Singapore for the application. It must be submitted online at least 4 weeks before the course begins.

The foreign student must have a local sponsor to apply to study here under this category. The local sponsor must be an individual aged 21 and above, who is an SC or SPR.

5 working days is the typical processing time.

Institutes of Technical Education (ITE)

The foreign student will need a local sponsor if applying to study at a Singapore Institute of Technical Education. The local sponsor must be either an SC or SPR who is 21 years old and above. Companies and organisations cannot act as sponsors.

If the parent or step-parent of the foreign student happens to be an SC or SPR, he or she must be the local sponsor.

Processing time is also 5 working days typically.

Same as above, the foreign student need not be in Singapore physically for the application. It has to be submitted online before the course begins, at least 4 weeks in advance.

Childcare Centres and Kindergartens

If you are enrolling your foreign child, into a childcare centre or kindergarten, ensure the school is licensed by the Early Childhood Development Agency (ECDA).

The application must be done online at least 2 months and less than 3 months before the course begins.

The typical processing time is 2 weeks.

Institutes of Higher Learning

Once the foreign student is offered a full-time course, the foreign student will need to apply for a Student’s Pass. Here is a list of the Institutes of Higher Learning that are eligible:

- Local (Singapore) Universities

- Nanyang Technological University (NTU)

- Singapore Management University (SMU)

- Singapore University of Social Sciences (SUSS)

- National University of Singapore (NUS)

- Singapore University of Technology and Design (SUTD)

- Singapore Institute of Technology (SIT)

- Local (Singapore) Polytechnics

- Singapore Polytechnic

- Ngee Ann Polytechnic

- Nanyang Polytechnic

- Republic Polytechnic

- Temasek Polytechnic

- Offshore Institutes With Campuses in Singapore

- INSEAD (Singapore)

- Sorbonne-Assas International Law School

- DigiPen Institute of Technology

- École Supérieure des Sciences Economiques et Commerciales

- SP Jain School of Global Management

- German Institute of Science and Technology – TUM Asia

Applicants need not be in Singapore physically. They can simply submit their applications online at least 1 month before the course begins and less than 2 months after the course has started.

Processing time is usually between 5 to 10 working days.

Exemption

The foreigner need not apply for a Student’s Pass if he/she:

- Has an Immigration Exemption Order; or

- Holds a Dependent Pass (DP); or

- Holds a Short-Term Visit Pass at the Singapore Checkpoint and wishes to attend a short course

Ready To Start Your Search For A School In Singapore?

We will help you with the entire process starting from school selection to enrolling into the school of your choice. We can assist to apply all relevant Visas for you and your family and provide all necessary assistance in relocating to Singapore. Contact us today!

Download the Telegram app and follow us for the latest updates: https://t.me/sgcompanyservices

Letter of Consent Application To Be Discontinued From 1st May 2021

Starting from 1st May 2021, all dependent pass holders in Singapore who wish to gain employment will have to apply for an applicable work pass, e.g. employment pass, S pass or work permit. This will be a major change from the prevailing practice. Currently, dependent pass holders can obtain employment with an approved letter of consent (loc) from the Ministry of Manpower.

Dependant Pass Holders Of Letter Of Consent Allowed To Work Till Expiry Date

Dependant pass holders with an existing letter of consent can continue to work till the date of expiry of the letter of consent. After which if they wish to continue, they will have to transit to the applicable work passes. The terms and conditions when applying for the passes will apply as per normal.

Letter Of Consent Holders Who Are Business Owners May Be Exempted

If the dependant pass holder with a LOC is a business owner, the above rule may not apply and he or she can continue to run their business. However, the following 2 conditions must be met:

- The dependant pass holder is a sole proprietor, partner, or company director with at least 30% shareholding in the company; and

- The business hires at least 1 Singaporean or Singapore Permanent Resident. It pays at least the prevailing qualifying salary (currently at S$1,400) and receives CPF contributions for at least 3 months.

Dependant pass holders who currently do not meet the above criteria can continue to run their business on their existing LOC until its expiry. They can also apply for a one-off extension of their LOC until 30 April 2022 when renewing their dependant pass. Thereafter, they will need to meet the criteria stated above in order to renew their LOC. Another option is to obtain an applicable work pass to continue working in Singapore.

Dependant pass holders who wish to start a business can apply for a LOC, as long they fulfil the criteria above.

Further details will be released on 1 May 2021.

If you need to apply for a letter of consent, do get in touch with a licensed employment agency in Singapore to assist you.

Download the Telegram app and follow us for the latest updates: https://t.me/sgcompanyservices

如何在新加坡开展进出口业务?

新加坡是世界上最繁忙的贸易中心之一,也是通往亚洲的门户,因此会是开展进出口业务的主要地点之一。让我们探讨如何开始在新加坡开展进出口业务。

成立贸易公司

议程上的第一件事将是与 ACRA(Accounting and Corporate Regulatory Authority) 在新加坡注册并成立一家公司。 这是一个相当简单的程序,如果您不熟悉,您可以随时聘请一个注册的 ACRA 公司秘书来帮助您组建新公司。 必须注意的重要一点是,在公司的业务活动下,选择最能描述您业务的相关 SSIC (Singapore Standard Industrial Classification) 代码。

与新加坡海关开户

成功建立公司后,您会收到该公司的 UEN(Unique Entity Number) 编号。这样,您就可以登录新加坡海关网站申请海关账户了。激活帐户后,您便可以开始申请海关许可证。您可以选择自己办理,也可以选择请报关代理人协助办理。由于手续可能相当麻烦,大多数企业将支付一个申报代理,并为他们解决工作。公司还必须准备一个运营银行帐户,以便直接从中支付关税或罚款。

将货物进口到新加坡

当您将货物进口到新加坡时,您必须向新加坡海关申报。这要先取得海关进口许可证。检查您的进口货物是否属于受管制物品,如果是的话您需要额外的清关步骤。

进口到新加坡用于消费的商品将被征收7%的消费税 (GST),以及对选定项目 (酒、烟草产品、汽车和石油产品) 征收相关的关税。

从新加坡将商品出口到国外

要将货物从新加坡出口到海外,您必须声报并且获得海关出口许可证。出口货物不征收消费税和关税。您还需要检查您出口的货物是否被列为受管制物品。

如果是这样的话,您将会被要求在出口前获得额外的许可。

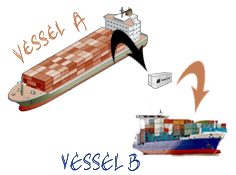

通过新加坡转运货物

转运是指货物在两个地方之间的移动,通过新加坡作为中间停靠港。由于货物不是进口到新加坡消费的,所以它们不受到消费税的控制。尽管如此,您仍然需要获得必要的海关许可证和检查受控项目的物品,才能继续进行转运。

原产地证书

原产地证书有助于确认出口货物的原产地。对于许多企业而言,新加坡标签有助于使消费者对产品的信心。

原产地证书由新加坡海关或任何认可的组织签发。签发原产地证书之前,都必须遵守一些规则。根据《进出口管理法》(RIEA)的规定,虚假申报是一种犯法行为。

外国人可以在新加坡开始进出口贸易吗?

简单的答案是可以的。对于想在新加坡开展进出口业务的外国人,没有附加任何其他条件。

以上文章的目的是简单的描述在新加坡如何开展进出口业务。由于不同商品的性质不同,涉及的复杂性和条例也很多。好消息是您可以随时向货运代理或代理商付费以处理海关申请。如果您有打算开启进出口业务,请立即与我们联系以了解更多信息!

下载 Telegram 应用程序以关注我们的频道,获取最新的资讯: https://t.me/sgcompanyservices

外国人在新加坡成立公司的指南

如果您是希望在新加坡成立公司的外国人,则本文将是您的指南,向您介绍整个过程和要求。

在开始之前,重要的是要考虑可用的各种公司结构。 身为外国人,您可以考虑通过股份公司或合伙企业的免税私人有限公司来开展业务。 在今天的文章中,我们将重点讨论建立股份公司免税私人有限公司的要求和步骤。

1.确定公司名称

首先确定适合您公司的名称。避免使用有争议的词,例如名人或国家与地区的名称或任何可能侵犯他人商标的名称。这样做可能会导致拒绝或延迟批准,从而反过来会延迟您的公司成立和运营所需的时间。

我们始终建议客户提出3种首选名称,并申请批准其中任何一种名称。完成此步骤后,您便可以继续注册该公司。

2.确定公司类型

您可以选择股份制私人公司,私人有限公司,股份制公众公司或担保股份制公司。这在很大程度上取决于公司将拥有的股东数量和股东的类型(是否有公司是股东)。

如果您要建立一个慈善组织或非营利组织,那么您的选择将是成立一家股份有限公司。

对于我们的大多数客户而言,一家私人有限公司将是最适合其目标的公司。您最多可以有20位股东,而所有股东都必须是自然法人。

3.任命董事和公司秘书

为了使公司运作,公司必须在董事会上至少有1名董事和1名公司秘书。

公司董事是被任命代表股东经营公司的高级职员。他或她必须始终为公司的最大利益行事。

董事必须年满18岁,并具有良好的法律和财务状况。

请注意,该公司必须至少有一位在新加坡的本地居民担任董事。当地居民是指新加坡公民,新加坡永久居民,创业特别准证持有人或就业准证持有人。

身为外国人在新加坡成立公司,您需要任命至少一位新加坡当地居民的董事。如果您没有合适的人选,则可以决定聘请挂名董事。

在6个月内,公司还必须任命某人为公司秘书。公司秘书必须是居住在新加坡本地的自然法人。

只要公司中至少有两名董事,则担任董事的人也可以担任公司的公司秘书一职。如果您聘请我们参与公司注册,我们将担任您的公司秘书。

4.股份和股东

该公司至少需要一位股东。 身为外国人,您可以成为公司的100%唯一股东。您需要决定在注册时要发行多少股份。 最低为新币$ 1。

当您在未来有更多的投资者时,您可以增加公司的已发行股份,以分配给既得利益方。

5.注册办事处

新加坡的所有本地公司都必须指定一个具有本地地址的注册办事处。 在这里,所有重要的信件都可以到达公司,并保留公司的所有重要文件和注册表。

该注册地址必须在办公时间内向公众开放。 它可能与您的公司运营所在的地址相同或不一样。

6.公司章程

公司章程是一份法律文件,规定了公司的治理方式,公司各利益相关方的权利和义务。 除非有特殊需求,否则我们建议使用 ACRA (Accounting and Corporate Regulatory Authority) 提供的模范公司章程。

7.财政年度结束

您还需要确定公司的财政年度结束日。 该日期将决定您的公司何时必须提交年度申报表。 这可以随后更改。

8.商业活动

在注册过程中,将要求您说明公司将从事的业务活动。您可以从预先确定的列表来做选择。 在开始营业之前,某些商业可能会需要您从相关政府部门获得某些行业的特殊许可证。

9.公司银行开户

仅在成功成立公司后才能开设公司银行帐户。

对于外资公司而言,银行进行的调查要严格得多。 但尽管如此,还是有可能做到的,而且我们的许多外国客户都已经成功开设了公司银行帐户。

准备提交申请以成立新公司

在提交之前,重要的是您首先要考虑以上提到的要点。 此后,您应该准备好所有股东的个人文件。 这些包括护照,地址验证等。

身为外国人,您将需要聘请注册公司代理人 (registered filing agent) 代表您进行注册。

如果您想了解有关在新加坡成立公司的成本以及更多其他的资料,请立即与我们联系!

下载 Telegram 应用程序以关注我们的频道,获取最新的资讯: https://t.me/sgcompanyservices

Market Readiness Assistance (MRA) Grant

Singapore based companies looking to expand their operations overseas can tap on the market readiness assistance (MRA) grant.

If your business is eligible, you can get support up to 70% of eligible costs, capped at S$100,000 per company per new overseas market. The cost will cover 3 main areas of overseas

- market promotion of up to S$20,000

- business development of up to S$50,000

- market set-up of up to S$30,000

Eligibility Criteria

To apply for MRA, your company must fulfil the following:

- The company is incorporated in Singapore

- The company must have at least 30% local shareholding

- Group annual sales turnover of not more than S$100 million; or company’s group employment size of not more than 200 employees

- Applicant must not have more than S$100,000 in overseas sales within intended target overseas country in each of last 3 preceding years

You can apply for as many MRA as you require. Your company may also apply to open several new markets at the same time. However, do note that the same expenses claimed via another grant will not be eligible for MRA reimbursement.

The Market Readiness Assistance Grant will be valid till 31st March 2023. Claims are disbursed on a reimbursement basis.

Getting Ready To Apply

It is important to note that the company should first make the application for MRA before signing any contract or commencing any form of work.

The services the company are claiming should be provided by an unrelated external third party.

The vendor should have a good track record of past completed projects to show. You need to detail the vendor's work scope, deliverables with the accompanying cost breakdown. An expected timeline of completion and milestones should also be listed.

If you are interested to find out more about how to best tap on the Market Readiness Assistance Grant, we have a team of qualified management consultants that are ready to assist. Get in touch with us today!

Download the Telegram app and follow us for the latest updates: https://t.me/sgcompanyservices

How To Start An Import/Export Business In Singapore?

As one of the busiest trading hubs in the world and the gateway to Asia, Singapore is probably one of the prime locations to start an import/export business.

Let us explore how you can get started doing an import/export business in Singapore.

Start A Trading Company

The first thing on the agenda will be to register and start a company in Singapore with ACRA. This is a rather straightforward process and if you are not familiar, you can always engage an ACRA registered filing agent to help you with the incorporation of a new company. The important thing to note is that under the company’s business activities, choose the relevant SSIC code which best describes your business.

Open An Account With Singapore Customs

Once you have your company successfully set up, you will receive the UEN number of the company. With this, you can then log onto the website of Singapore Customs to apply for a customs account.

With the account is ready, you may then start to apply for custom permits. You can either opt to do it yourself or to engage with the help of a declaring agent. As the procedure can be rather troublesome, most businesses will pay a declaring agent and have the work cut out for them.

It is also a must for the company to have ready an operating bank account whereby the custom duties or penalties will be paid from directly.

Importing Goods Into Singapore

When importing goods into Singapore, you need to make a declaration to Singapore Customs.

This is done by first obtaining a customs import permit. Do check if your goods being imported are controlled items as additional clearance will be required.

Goods imported into Singapore for consumption will be subjected to Goods and Services Tax (GST) at 7% as well as duties payable on selected items (intoxicating liquors, tobacco products, motor vehicles and petroleum products).

Exporting Goods Out of Singapore

To export goods out of Singapore, you must make a declaration and obtain a customs export permit. GST and duties are not levied on export goods.

You should also need to check if the goods you are exported are controlled items. If so, you will be required to get additional clearance before you can export.

Transhipping Of Goods via Singapore

Tranship refers to the movement of goods between 2 places via Singapore as an intermediate port of call. As the goods are not for consumption in Singapore, GST does not apply to them.

Nevertheless, you will still need to obtain the necessary custom permit and check for controlled items status before you can proceed.

Certificates Of Origin

The certificate of origin helps to confirm the origin of the goods exported. For many businesses, the Singapore label helps to give consumers confidence in the product.

Certificates of origin are issued by Singapore Customs or any of the approved organisations. There are a set of rules that you must adhere to before receiving the certificate of origin. Making a false declaration is an offence under the Regulation of Imports and Exports Act (RIEA).

Can Foreigners Start Import/Export Business in Singapore?

The simple answer is yes. There are no additional conditions upon foreigners for wanting to start an import and export business in Singapore.

The above article serves to give a general overview of starting an import/export business in Singapore. There are a lot more intricacies involved due to the varying nature of different goods. The good thing is you can always pay for freight forwarders or agents to handle the customs applications. If you wish to start your process, do check with us today to find out more!

Download the Telegram app and follow us for the latest updates: https://t.me/sgcompanyservices

What Is Shelf Company And How To Purchase One In Singapore?

In Singapore, a shelf company is one that is incorporated as per the statutory requirements but is dormant. It means that the company is no longer in operation and does not carry out any business activities. Typically, a shelf company remains dormant until someone else acquires it and starts operating it once again.

Benefits of acquiring shelf companies

There are 2 benefits of buying a shelf company versus registering a brand new company to begin your company operations.

- You can avoid the time taken for the registration process for a brand new company. Once you have completed the transfer of ownership, you may begin operating. In other words, you will save yourself quite a fair bit of time.

- It may be easier to obtain business loans. Shelf companies are usually already in existence for a number of years before being bought over. Mature companies will usually get more preference from most banks or financial institutions.

A mature shelf company will definitely come at a premium price tag. Prices typically range from S$2,000 to more than S$10,000. The main determining factor of the premium is normally based on the shelf company's age.

It is critical to be mindful that you do your verification that the shelf company is cleared of any liabilities (financial).

If you have decided to buy a shelf company, you can proceed to seek out a suitable company that you want to buy. Again, the biggest deciding factor will be based on the age of the company.

After which, you negotiate on the price and terms of sale with the seller, followed by the signing of the transfer agreement, so you can take over the ownership of the company.

After taking over

You can now decide to change the company’s name and address, you may also appoint new directors and shareholders. Should you and the new shareholders decide to, all of you can amend the company constitution with the Accounting and Corporate Regulatory Authority (ACRA), as well although we do not recommend that.

If you wish to purchase a shelf company in Singapore, do feel free to get in touch with us! We can handle the entire purchase process to make it as easy for you as possible.

Download the Telegram app and follow us for the latest updates: https://t.me/sgcompanyservices